Doing so results in simple, periodic interest.

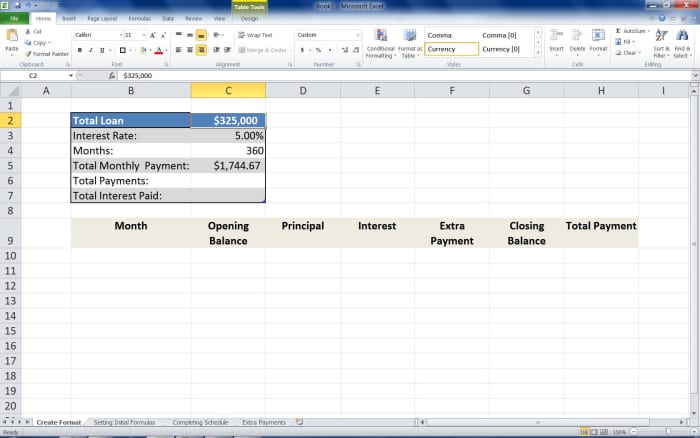

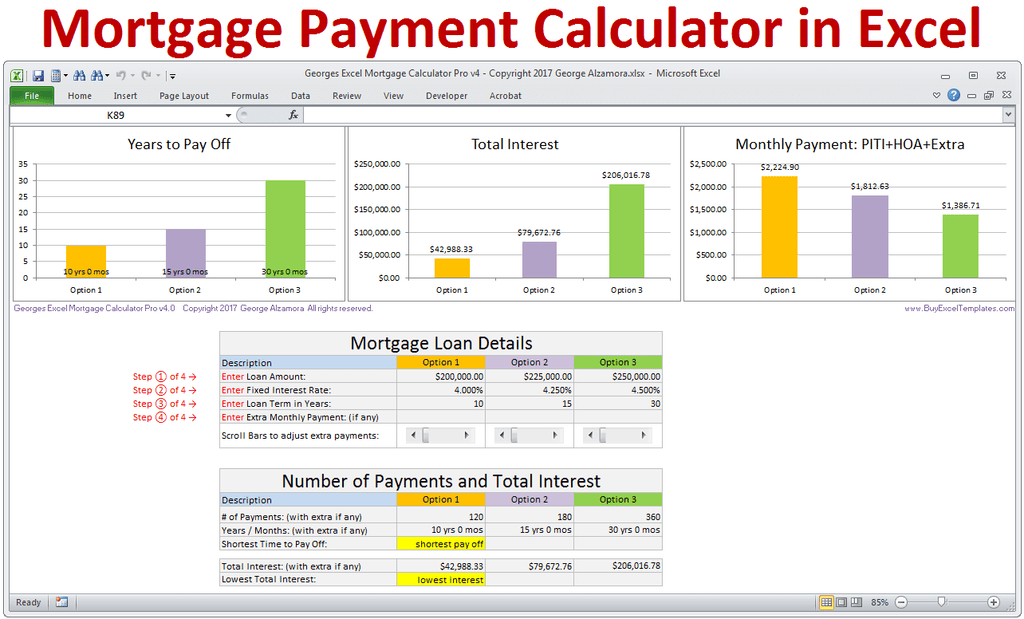

The amount includes only principal and interest. Mortgage Payment (P & I only) - the amount due on each payment due date.This the quoted interest rate for the mortgage. Annual Interest Rate - the nominal interest rate.(360 monthly payments = 30 year mortgage) For a term of thirty years, if the payment frequency is monthly, you need to enter 360 for the number of payments. The "Payment Frequency" setting also impacts the loan's term. Number of Payments - the length of the loan.Or enter the mortgage amount and zero for the down payment and price.Enter the mortgage amount and down payment to calculate the affordable real estate amount.Enter the real estate price and the down payment to calculate the mortgage amount.Mortgage Loan Amount - the amount of the mortgage loan.Down Payment Amount - the anticipated down payment expressed as an amount.Down Payment Percent - the anticipated down payment expressed as a percent of the purchase price.Price of Real Estate or Asset - the negotiated purchase price.Related: Whether you’re thinking of buying a home, already have a home loan, or are having trouble paying your mortgage, see The Consumer Financial Protection Bureau (CFPB) website for consumer resources to help you "every step of the way." There are only six values you will usually need to set. More details about the available calculation options for odd day and irregular period interest.

#MORTGAGE LOAN CALC FULL#

If you are satisfied with approximations, however, or you want to match other calculators, then set the "Mortgage Closing Date" and "First Payment Date" so that the time between them equals one full period as selected in "Payment Frequency." Example: If the "Mortgage Date" is July 15 and the "Payment Frequency" is "Monthly," then the "First Payment Date" should be set to August 15. This will result in payment amounts and interest charges that do not match other calculators.Īnd that's the point! You do not need to settle for estimates. Long and short first periods impact interest and payment calculations.īy giving users the ability to enter these two dates, this calculator can do penny perfect calculations.

Such a scenario leads to what is commonly called a "long initial period" and "odd days interest." (Had the first payment been due on August 1, then the first period would be called an "initial short period.") Your mortgage can require monthly payments, but in reality, you might go to the closing on July 15, and the first payment might not be due until September 1.

Keep in mind that with a low down payment mortgage insurance will be required, which increases the cost of the loan and will increase your monthly payment.Conventional fixed-rate loans are available with a down payment as low as 3%.Wells Fargo offers several low down payment options, including conventional loans (those not backed by a government agency).

0 kommentar(er)

0 kommentar(er)